A Stock Reborn, A Company in Transition

Tesla, the world’s most visible electric vehicle maker, has staged a remarkable stock rally in September 2025 (rebounding from a rocky start to the year). A significant driving force behind this turnaround has been Elon Musk’s bold $1 billion buy-in (a move widely seen as an unambiguous vote of confidence in the company’s long-term direction). As Tesla doubles down on artificial intelligence and robotics, it aims to sustain its edge in a fast-evolving market (even as short-term performance metrics pose tough questions for investors and analysts alike).

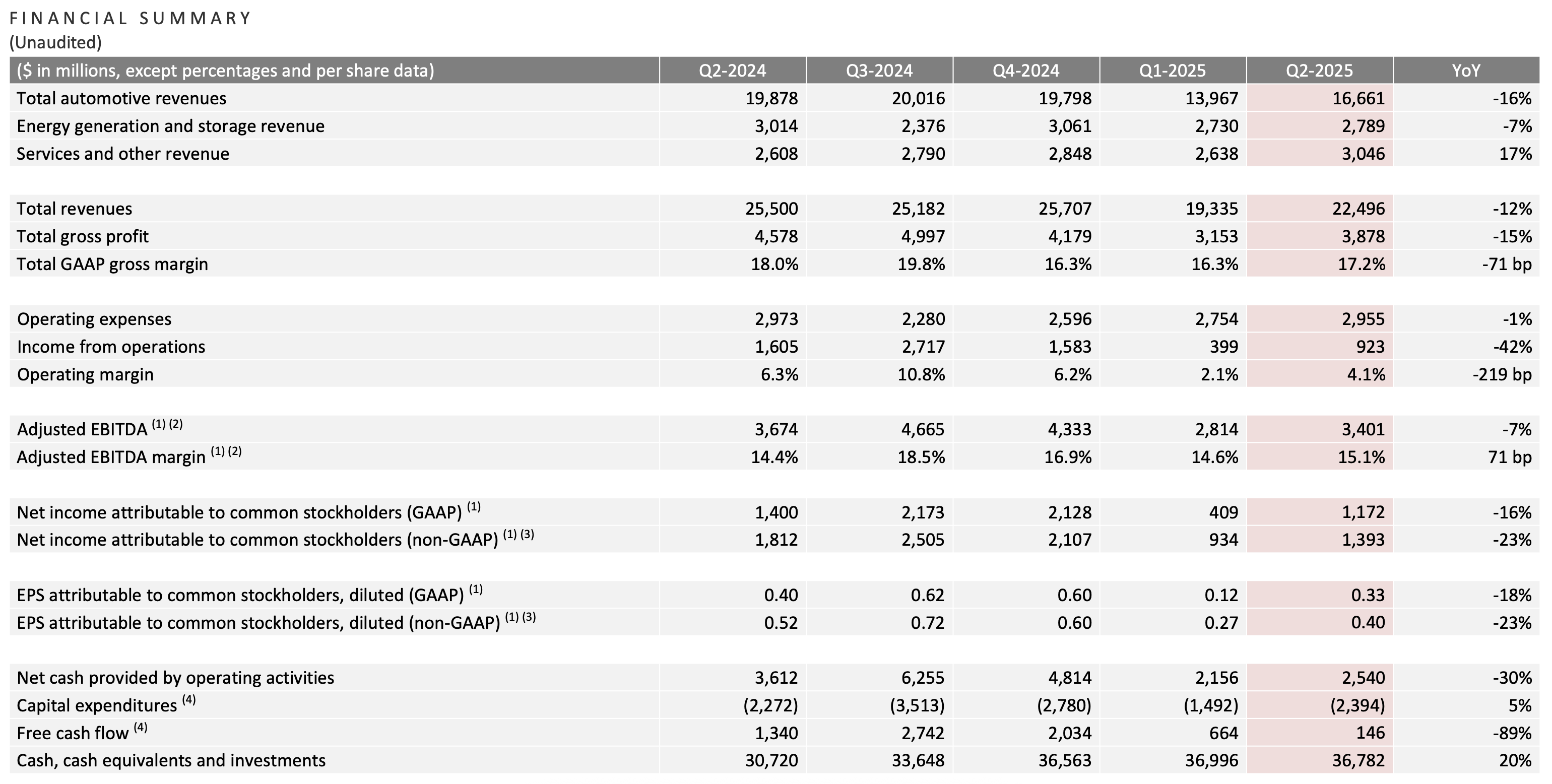

Financial Performance and Recent Challenges

Tesla’s financials for Q2 2025 reflect a company at the crossroads of reinvention and adversity. Revenues dropped 12% year-over-year to $22.5 billion, and net income slid by 16% compared to Q2 2024. Diluted earnings per share declined 18% to $0.33, and both operating and free cash flow have suffered (the latter plunging 89%).

Contributing factors include:

Lower vehicle deliveries and reduced regulatory credit revenue

Margin pressures amid pricing competition

Increased capital expenditures as Tesla pivots to AI and robotics

Despite these setbacks, the company ended the quarter with a robust $36.8 billion in cash (demonstrating significant financial resilience for its strategic investments).

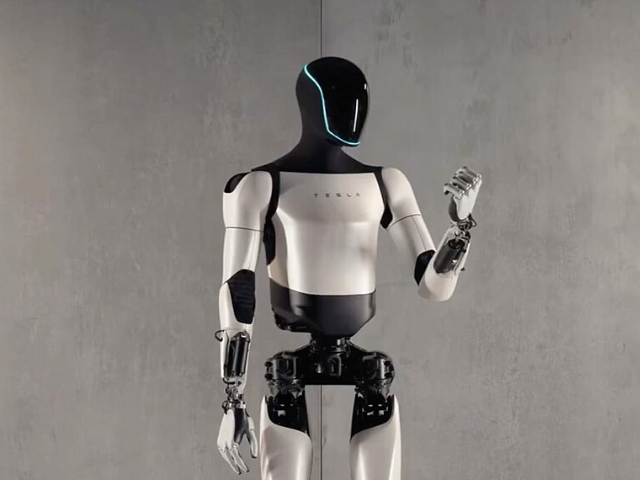

Innovation: AI, Robotics, and the Road Ahead

Tesla’s evolution from an EV giant to a technology disruptor is underscored by its aggressive push into AI and robotics. Musk has reaffirmed Tesla’s strategic focus on:

Expanding the Cybertruck-based U.S. robotaxi network

Accelerating the rollout of the Optimus general-purpose robot for manufacturing, logistics, and broader applications

Increasing production at GigaBerlin to meet rising global demand for Model Y and future models

Analysts note the high stakes of this pivot (while the AI and robotics markets promise massive upside, they require navigating regulatory uncertainties, scaling manufacturing, and maintaining EV leadership amid fierce competition from firms like Waymo and Boston Dynamics).

Leadership: Securing Musk’s Vision for the Future

To stabilize leadership through this critical period, Tesla has granted Musk $29 billion in time-vested shares (elevating his stake to 16% and aiming to secure his focus on the company’s ambitious roadmap through at least 2030). This move, while raising some governance concerns due to Musk’s external ventures and political involvements, reflects the board’s belief that his vision and personal engagement are indispensable for Tesla’s innovation pipeline and long-term growth.

Market Sentiment and Outlook

Tesla’s September rally (erasing earlier 2025 stock losses) reflects both renewed investor optimism and persistent volatility. The market narrative is now less about short-term EV sales and more focused on whether Tesla can truly scale its AI and robotics ambitions. The company’s valuation remains lofty compared to revenue but may prove justified if it successfully executes on new technology bets.

Yet, risks loom:

Production bottlenecks at Texas and Berlin Gigafactories

Regulatory headwinds in autonomous tech adoption

Competitive threats from both established automakers and specialized tech firms

Betting on Innovation, Embracing Uncertainty

Tesla’s story in 2025 is one of transformation, resourcefulness, and strategic risk-taking. While near-term financials highlight tough challenges, Musk’s capital commitment and Tesla’s pivot to AI and robotics suggest a willingness to redefine the frontier of mobility and automation. The next year will be pivotal in proving whether these bold moves yield sustainable innovation (or merely fuel more market speculation).