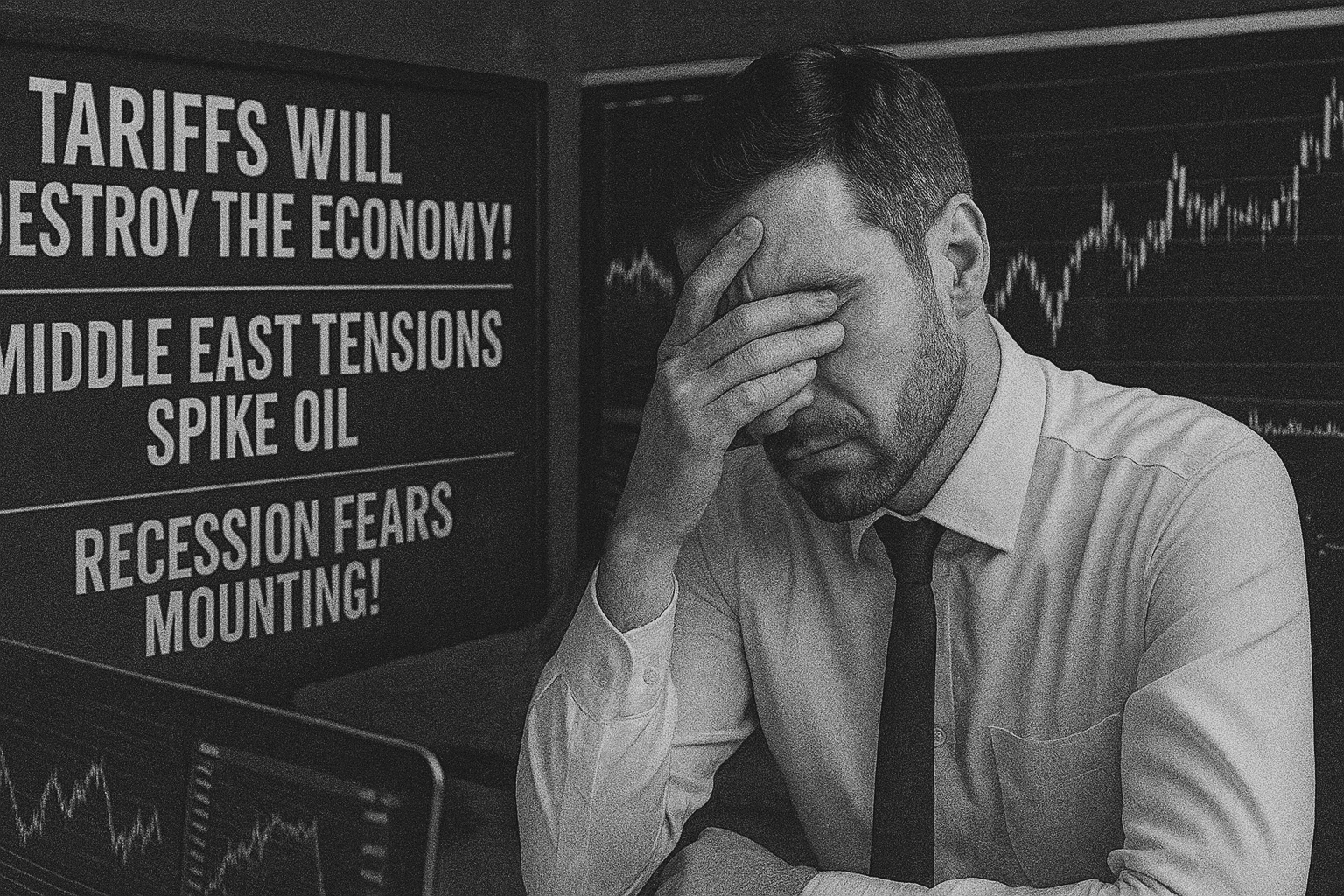

Every morning you wake up to the same financial media circus. Monday it's "TARIFFS WILL DESTROY THE ECONOMY!" Tuesday it's "MIDDLE EAST TENSIONS SPIKE OIL!" Wednesday brings "RECESSION FEARS MOUNTING!" And by Thursday, we're back to "CRYPTO ADOPTION CHANGING EVERYTHING!"

No wonder your portfolio feels like it's being managed by a drunk toddler with ADHD.

Here's the truth nobody wants to tell you: Most of the headlines screaming for your attention don't actually matter for your money. The financial media makes money from clicks, not from making you rich. Chaos sells. Boring, steady wealth building doesn't.

So let's cut through the noise and talk about what actually moves your portfolio, not what moves page views.

The Headlines vs. Reality Check

What the headlines say: "Trade war escalation sends markets tumbling!" What actually happens: S&P 500 drops 0.8%, recovers within two days, hits new highs the following week.

What the headlines say: "Crypto crash wipes out billions!" What actually happens: Bitcoin drops from $107K to $95K, which is still up 400% from two years ago.

What the headlines say: "Recession fears as jobless claims rise!" What actually happens: Claims tick up 0.1%, unemployment still near historic lows, consumer spending keeps growing.

See the pattern? The media takes normal market volatility and turns it into the financial apocalypse. Every dip becomes a crash. Every geopolitical tension becomes world war three. Every economic data point becomes either the greatest boom or worst bust in history.

Your job as an investor isn't to react to every headline. It's to separate signal from noise.

What Actually Moves Markets (The Numbers That Matter)

Forget the drama. Here's what you should actually be watching:

Corporate Earnings Growth Not the headlines about earnings "disappointments," but the actual numbers. Are companies making more money quarter over quarter? Are profit margins expanding? Revenue growth tells you if the economy is actually working, not what some talking head thinks about it.

Interest Rate Direction The Fed's decisions matter more than any trade war tweet. When rates go up, growth stocks get hit. When rates go down, everything rallies. It's that simple. Watch the 10-year Treasury yield, not the inflation scare stories.

Money Flow Data Where is institutional money actually going? Fund flows into sectors tell you what smart money believes, not what they're saying on TV. When pension funds and hedge funds start piling into energy stocks, that matters more than oil price predictions.

Consumer Spending Patterns Americans spend money, economy grows. Americans stop spending, economy shrinks. Watch retail sales, not recession forecasts. People's actual behavior beats economists' models every time.

How to Follow the Smart Money

13F Filings Are Your Friend Every quarter, big hedge funds have to report their holdings. Warren Buffett bought more Apple? That matters. Some hot shot fund manager dumped all their tech stocks? Pay attention. This is real money making real bets, not TV personalities making predictions.

ETF Flows Tell the Story When $2 billion flows into technology ETFs in a week, that's institutions voting with their wallets. When money pours out of bond funds and into stock funds, that's a risk-on signal. Follow the money, not the mouth.

Insider Trading Activity (The Legal Kind) Corporate executives buying their own stock with their own money is the ultimate vote of confidence. Mass insider selling usually means trouble ahead. These people know their companies better than any analyst.

Options Flow for the Advanced Unusual options activity can signal big moves before they happen. When someone buys $50 million in call options on a random Tuesday, they probably know something. This takes practice to read, but it's pure signal.

The Noise Filter Framework

Ask These Questions Before Reacting:

"Does this actually change business fundamentals?" A tariff threat might matter. A politician's tweet probably doesn't.

"Is this temporary or permanent?" Oil spikes during geopolitical tensions usually fade. Demographic shifts last decades.

"What are companies actually doing?" Share buybacks, dividend increases, and capital spending tell you more than conference calls.

"How much money is really at stake?" A $10 billion crypto hack sounds huge until you remember the entire crypto market is worth $3 trillion.

The Big Picture Checklist

Instead of panicking about daily headlines, check these monthly:

Economic Momentum: Are GDP, employment, and consumer confidence trending up or down over six months? Short-term wiggles don't matter.

Sector Rotation: What's leading the market? Tech stocks leading usually means growth mode. Utilities and consumer staples leading means defensive mode.

Credit Spreads: How much extra yield do corporate bonds pay vs. Treasuries? Widening spreads mean credit stress. Tight spreads mean confidence.

Currency Trends: A strong dollar hurts international stocks and commodities. A weak dollar helps. Simple as that.

What to Actually Do With This Information

Build Your Core Holdings First Before you try to trade headlines, make sure 70-80% of your portfolio is in boring, diversified index funds or solid companies that make money regardless of news cycles. Let the professionals worry about timing every trade war tweet.

Set Allocation Targets and Rebalance Decide what percentage you want in stocks, bonds, international, etc. When headlines push your allocation way off target, rebalance back. Buy what went down, trim what went up. Boring but effective.

Keep Some Dry Powder Always have 5-10% cash available for real opportunities. When actual crashes happen (not the fake ones the media loves), you want money ready to deploy.

Focus on Time Horizons Daily headlines matter for day traders. Monthly trends matter for swing traders. Annual patterns matter for long-term investors. Match your attention span to your investment timeline.

The Contrarian Secret Weapon

When everyone's freaking out, that's usually when opportunities appear. March 2020 was peak panic, perfect buying opportunity. October 2022 everyone thought recession was guaranteed, market bottomed that month.

The best investments often come when headlines are most negative and everyone's terrified. That's when quality companies trade at discounts because scared money is selling to smart money.

Bottom Line: Focus on Facts, Not Fear

The financial media industrial complex needs you anxious and clicking. Your portfolio needs you calm and rational.

Trade the charts, not the headlines. Follow the money, not the mouth. Focus on numbers, not narratives.

Every crisis feels like the end of the world when you're living through it. But markets have survived world wars, nuclear standoffs, financial collapses, and global pandemics. They'll probably survive whatever Twitter is freaking out about this week.

Your job isn't to predict the next crisis or time the next rally. It's to build a portfolio that can handle whatever chaos the world throws at it while you focus on the stuff that actually matters.

Like making money. You know, the whole point of this game.